How Likely Is a Recession, and How Much Will It Affect Things?

Author: Charles Ouko

The US economy may be heading into a recession due to hot inflation. The Federal Reserve has increased interest rates many times this year, the most recent increase being the greatest in over three decades. However, the inflation rate, which is currently 8.6 percent, has not been much reduced. Fed Chief Jerome Powell told Congress last week that the bank's efforts to combat excessive inflation might result in a more severe collapse.

Gross domestic product, or GDP, a crucial indicator for determining economic growth and recessions, is the value of all products and services generated inside a nation during a given period and is used by economists to determine if we are officially in one. For example, the US GDP shrank by 1.4 percent in the first quarter of 2022. Technically, a recession is declared when the GDP declines for two consecutive quarters.

As recession concerns grow, you're undoubtedly worried about what this may entail for your money and employment. This is how you could get through this challenging financial time.

What could I first expect from a recession?

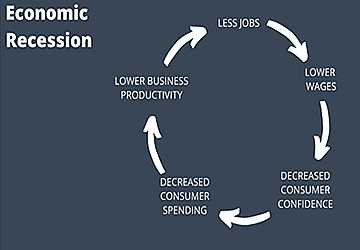

Reviewing recession results in the past is usually beneficial so that we can control our expectations. Although each recession's duration, severity, and effects vary, we often experience increased layoffs and joblessness during economic downturns. In addition, because banks are concerned about default rates, access to the credit market might become more difficult, and they would be reluctant to provide loans.

If the Federal Reserve keeps raising interest rates to combat inflation, the cost of borrowing will balloon, for example, on mortgages, auto loans, and business loans. The interest rate will thus be greater than the previous year, even if you are approved for a credit card or loan.

The only positive aspect of certain recessions is that when interest rates rise and inflation slows, prices for goods and services decrease, and, depending on the state of the labor market and earnings, our private savings rates may rise. In addition, as the newly jobless frequently look for methods to make a small company concept into reality, we could also observe an increase in entrepreneurship, similar to what we witnessed in 2009 during the Great Recession.

Should I halt my 401(k) investments?

Since markets have been down for many weeks, many people are curious about how a recession would affect their long-term investments. Is it time to stop investing? The quick response is "no," Unless you can avoid it. Don't panic and payout if you can handle the volatility or observe the down arrows.

My suggestion is to refrain from having emotional reactions. Reviewing your investments now to ensure they are well-diversified may be a smart idea. Then, if your risk tolerance suddenly changes for whatever reason, discuss it with a financial professional to see whether your portfolio needs to be adjusted.

The market has historically been profitable. The Great Recession caused many investors to cash out their 401(k)s, missing out on a potential recovery. Currently, The S&P 500 has increased by about 150 percent since its 2009 lows, when adjusted for inflation, notwithstanding the current decline.

The only exception is if you have no other method to pay for the emergency expenditure, such as a medical bill, and you need the funds you have in the stock market to cover it. If so, you might wish to investigate your possibilities for 401(k) loans. If you choose to borrow money from your retirement account, commit to repaying it as soon as possible.